-

Short Term

Short Term

Business LoansThe interest rate you will pay and the amount you can borrow will depend

on your annual business revenue and business banking history. Personal credit history may also be a factor.Short-term business loans focus on cash flow as the primary underwriting foundation.

Strong cash-flow can act as a compensating factor to offset other negative financial information that would disqualify

a business for a traditional bank loan.Find Out MoreThe interest rate you will pay and the amount you can borrow will depend on

your annual business revenue and business banking history.

Personal credit history may also be a factor.Short-term business lenders underwrite based on cash-flow more than lenders

of traditional or “long” term loans. Strong cash-flow can act as compensating factor

to offset other negative financial information that would disqualify

a business for a traditional term loan.Short-term business loans focus on

cash flow as the primary underwriting

foundation. Strong cash-flow can

act as a compensating factor to offset

other negative financial information that would

disqualify a business for a traditional bank loan.

-

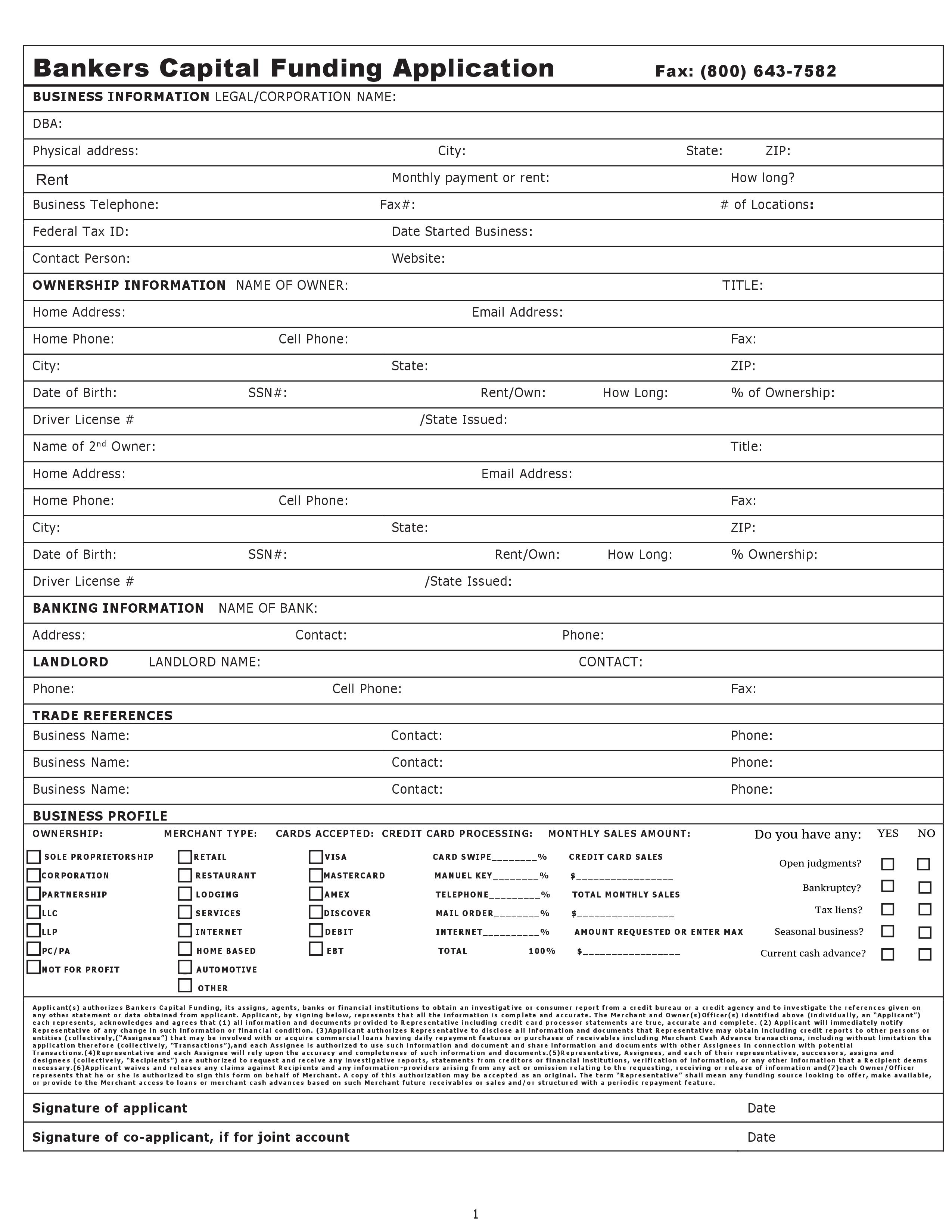

Getting approved for a Short Term Business Loan is a fast and easy process:Applying for a Short Term Business LoanJust complete a simple one page application

Getting approved for a Short Term Business Loan is a fast and easy process:Applying for a Short Term Business LoanJust complete a simple one page application

and provide your recent business bank statements.Approvals take 24-48 hours and funds are available in about 5 business days*Connect with an agent and get professional consulting.Connect NowDownload .PDFApply online DocuSign®Applying for a Short

Term Business LoanGetting approved for a Short

Term Business Loan is a fast and easy process:Approvals take 24-48 hours and

funds are available in about 5 business days*

-

Overall, it’s a straightforward loan product...Short-Term Loans DefinedYou receive a set amount of cash upfront that you agree to pay back,

Overall, it’s a straightforward loan product...Short-Term Loans DefinedYou receive a set amount of cash upfront that you agree to pay back,

along with the lender’s fees and interest, over a predetermined period of time.But with short-term loans for business, loan amounts may be smaller, the repayment period

drastically shorter, interest rates higher, and you often pay the lender back on a daily or weekly instead of monthly schedule.On the flip side they're:Easier to qualify forFaster to applyQuicker to fundContact a RepresentativeYou receive a set amount of cash upfront

that you agree to pay back,

along with the lender’s fees and interest, over

a predetermined period of time.Short-Term

Loans DefinedOn the flip side

they're:

-

The speed and ease of application makes a short-term business loan deal riskier for the lender.

The speed and ease of application makes a short-term business loan deal riskier for the lender.

They spend less time vetting your business and checking that you’ll be able to pay back on time and have a history of doing so.

Because short-term loans tend to fund for riskier borrowers, they tend to have more expensive interest rates.Why do they come with high interest rates?The speed and ease of application makes a short-term

business loan deal riskier for the lender.

They spend less time vetting your business and checking

that you’ll be able to pay back on time and have a history of doing so.

Because short-term loans tend to fund for riskier borrowers,

they tend to have more expensive interest rates.Why do they come

with high interest rates?

-

Anyone who runs a small business knows: it takes money to make money...Best Uses for Short-Term LoansWhat if you have the opportunity to fill a massive order for a customer who can pay you in 60 days,

Anyone who runs a small business knows: it takes money to make money...Best Uses for Short-Term LoansWhat if you have the opportunity to fill a massive order for a customer who can pay you in 60 days,

but your supplier needs to be paid in a week?Without access to cash, you might have to pass up that golden opportunity.Download .PDFApply online DocuSign®Do you have a seasonal small business that needs an influx of capital just before the holiday season?Getting a short-term business loan would give you the funding to cover promotional expenses

and build your inventory well before the holidays—even though you might be short on cash right now.Trying to find a way to fund business expansion, refinance other short-term debts at more favorable

terms, pay upcoming taxes, and put extra cash into your business?Take advantage of new opportunities, or meet pretty much any short-term financing need.

Fast financing gives you the flexibility to spend how you need.Best Uses for

Short-Term LoansAnyone who runs a small business knows:

it takes money to make money...What if you have the opportunity to fill a massive order

for a customer who can pay you in 60 days,

but your supplier needs to be paid in a week?Do you have a seasonal small business that needs

an influx of capital just before the holiday season?Getting a short-term business loan would give you the funding

to cover promotional expenses and build your inventory well before

the holidays—even though you might be short on cash right now.Trying to find a way to fund business expansion,

refinance other short-term debts at more favorable terms,

pay upcoming taxes, and put extra cash into your business?Take advantage of new opportunities, or meet pretty much

any short-term financing need. Fast financing gives you the

flexibility to spend how you need.